The simple answer is: They’re rising, too!

For anyone who watches energy markets, the latest trend is clear — prices are rising. Energy prices bottomed out last April during the height of the COVID lockdown and Saudi oil price war, with crude oil pricing even going negative at one point! Markets then stabilized through the summer and fall as consumer and business consumption began normalizing. Finally, the trend turned higher starting in November with the first COVID vaccine approvals. Since then, energy prices have come roaring back and continued moving, for the most part in one direction — up.

One of the most common questions the Crystal Flash Team hears from our customers is, “If oil moves up, what does that mean for diesel and gasoline prices?” In other words, customers want to know how much the price of a gallon of fuel goes up for every dollar increase in the price of crude oil.

Unfortunately, there is no simple answer to, “What will fuel costs be based on the cost of crude oil?”, but the combination of historical data and our understanding of market dynamics provides some insight into what future fuel prices could look like.

Some things to keep in mind:

- Diesel and gasoline are usually profit-generating products for oil refiners, meaning that fuel product prices per barrel are almost always higher than crude oil.

- A refinery’s fuel product “sale price” changes day to day, minute-by-minute.

- Theoretically, similar to most consumer goods, the sale price of refined fuels is market driven: supply vs. demand, taking production costs, inventories and other variables into consideration.

- The sale price of fuel is monitored by something called a “crack spread”, which is the difference between the sale price of a barrel of refined fuel compared to the cost of a barrel of crude oil.

- The higher the “crack spread”, the greater a refinery’s gross margin. However, this doesn’t necessarily translate to higher or lower outright prices, as the crack spread is just a relative value between refined products and crude oil.

Unlike other consumer markets, where a 10% increase in raw goods can directly translate into a 10% increase in cost on the consumer end, the changing cost of crude oil will not result in a consistent outcome. The value of the refined fuels themselves have their own market dynamics that impact their relative value to crude oil. The complexity of the fuel market is why Crystal Flash regularly monitors a variety of market indicators and reviews historical data to help predict a generalized fuel cost. Generally speaking, though, if crude prices are rising, so are refined fuel prices.

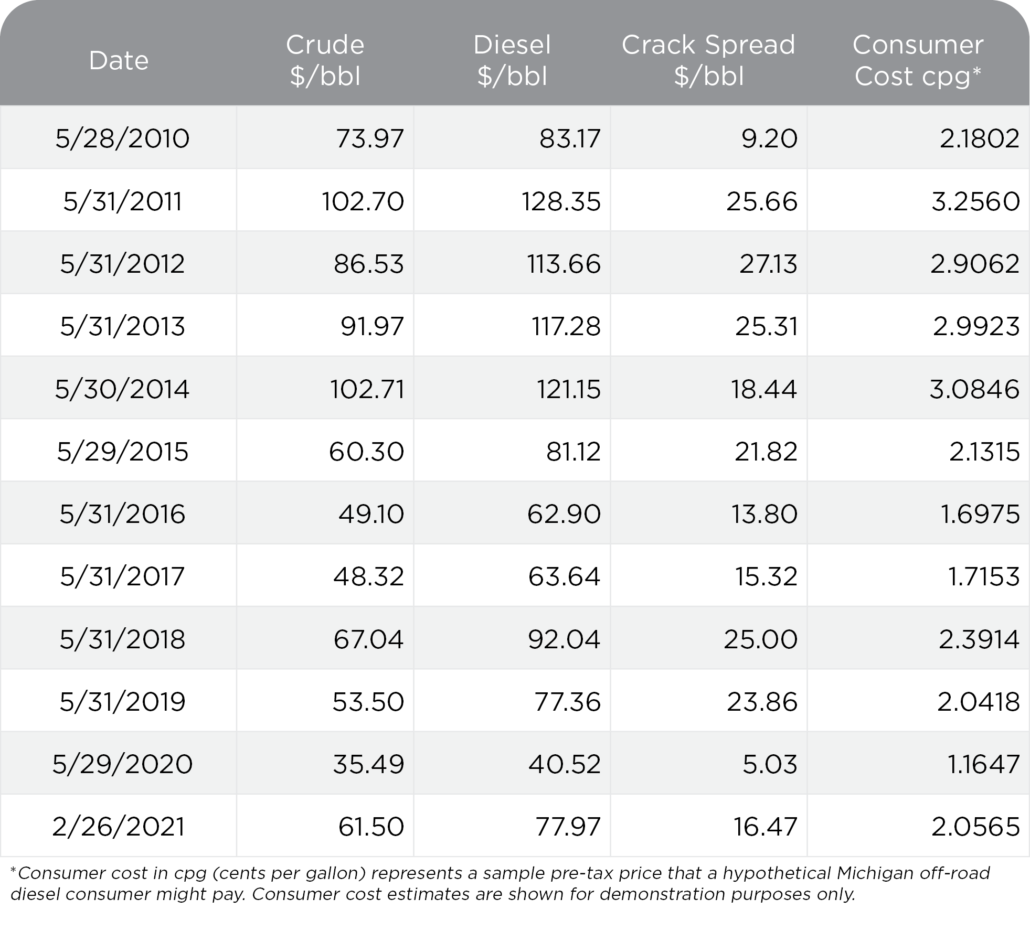

Here is a table that gives some examples of how crude and diesel prices can change over time. This table includes price data from the last trading day in May over the past decade and finishes with current prices at the time this article was published. As you can see, crude and diesel prices vary greatly over time, but again, generally speaking, as oil heads higher, diesel and gasoline will typically go along for the ride.

As you can see, crude and diesel prices vary greatly over time, but again, generally speaking, as oil heads higher, diesel and gasoline will typically go along for the ride.